A new report released by the Rainforest Action Network (RAN) has revealed the world’s 60 biggest banks have provided finance to fossil fuel companies at a total of $3.8 trillion US dollars ($4.9 trillion AUD) since the establishment of the Paris climate agreement. This lending relates to the extraction and burning of fossil fuels, along with enabling infrastructure such as ports and pipelines.

The full datasets reveal that Australia’s ‘big four‘ banks – ANZ, Commonwealth, NAB and Westpac, have contributed a total of $84 billion Australian dollars in the years since the Paris climate agreement. 2018 and 2019 were peak years, and though 2020 has seen a fall in lending to fossil projects from Australia’s banks, it was still higher in amount lent than both 2016 and 2017. This is in line with the global trends.

The report includes a case study on a coal mine being developed by an Australian subsidiary of Adani, recently renamed ‘Bravus’. “Over 40 banks have publicly committed to refrain from financing the Carmichael mine. However, in December 2020 it was reported that State Bank of India is ready to offer Adani a loan of approximately $678 million for the project”, the authors say. Several banks, such as Bank of America and Barclays, have made commitments not to fund either coal or the Carmichael coal mine specifically, but are underwriting bond assurances for the rail project that will transport coal from the mine to a nearby port.

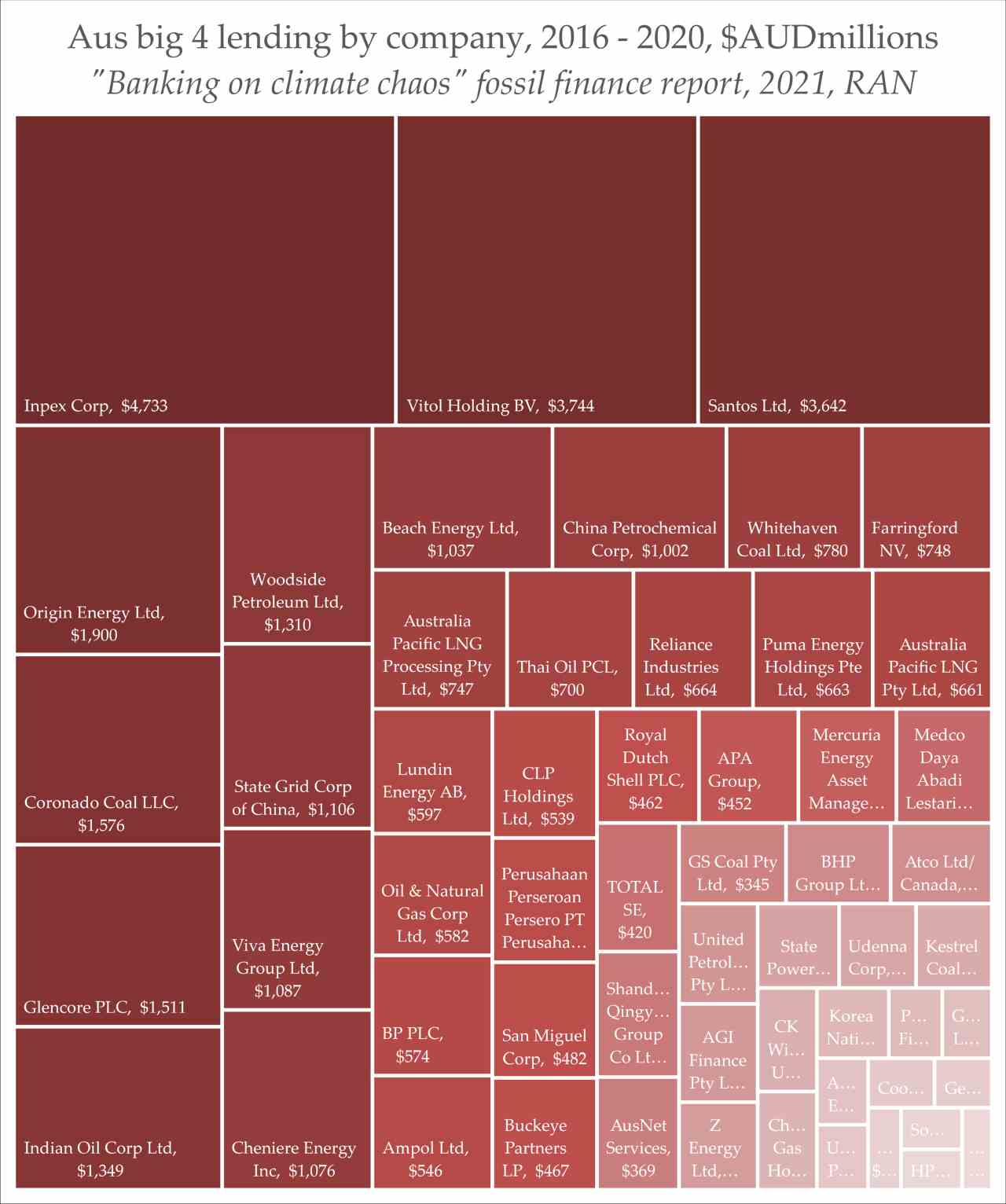

The report also specifically names ANZ as “Australia’s worst funder of fossil fuels, for five years in a row”. Commonwealth Bank and NAB both have net zero by 2050 targets, and Westpac and ANZ have pledged to set targets in the short term. However, all four continue to lend money to or underwrite the projects of large fossil fuel companies. The data provided in the report show that Australia’s banks are lending to several international organisations, and several domestic fossil fuel companies too:

The report calls for banks to establish policies that prohibit financing of fossil fuel extraction and infrastructure along the whole value chain, and to respect human rights, and Indigenous rights in particular. “The Wangan and Jagalingou people, traditional owners of the land, have not consented to the Carmichael mine, which they’ve been fighting for years. In the fight to stop the project, Adrian Burragubba, spokesman for the Wangan and Jagalingou family council, was bankrupted after Adani sought reimbursement for court costs”, the report says.

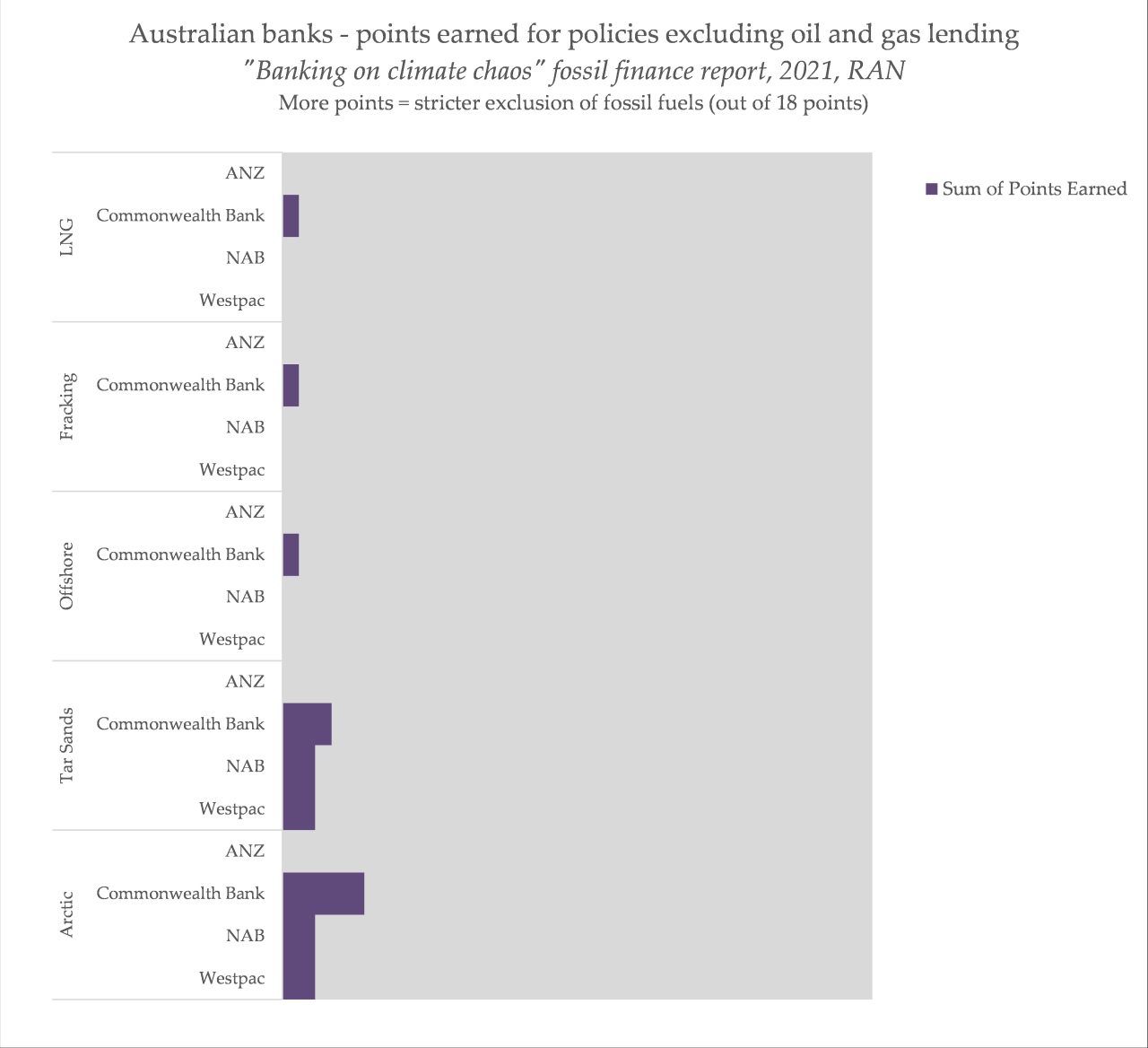

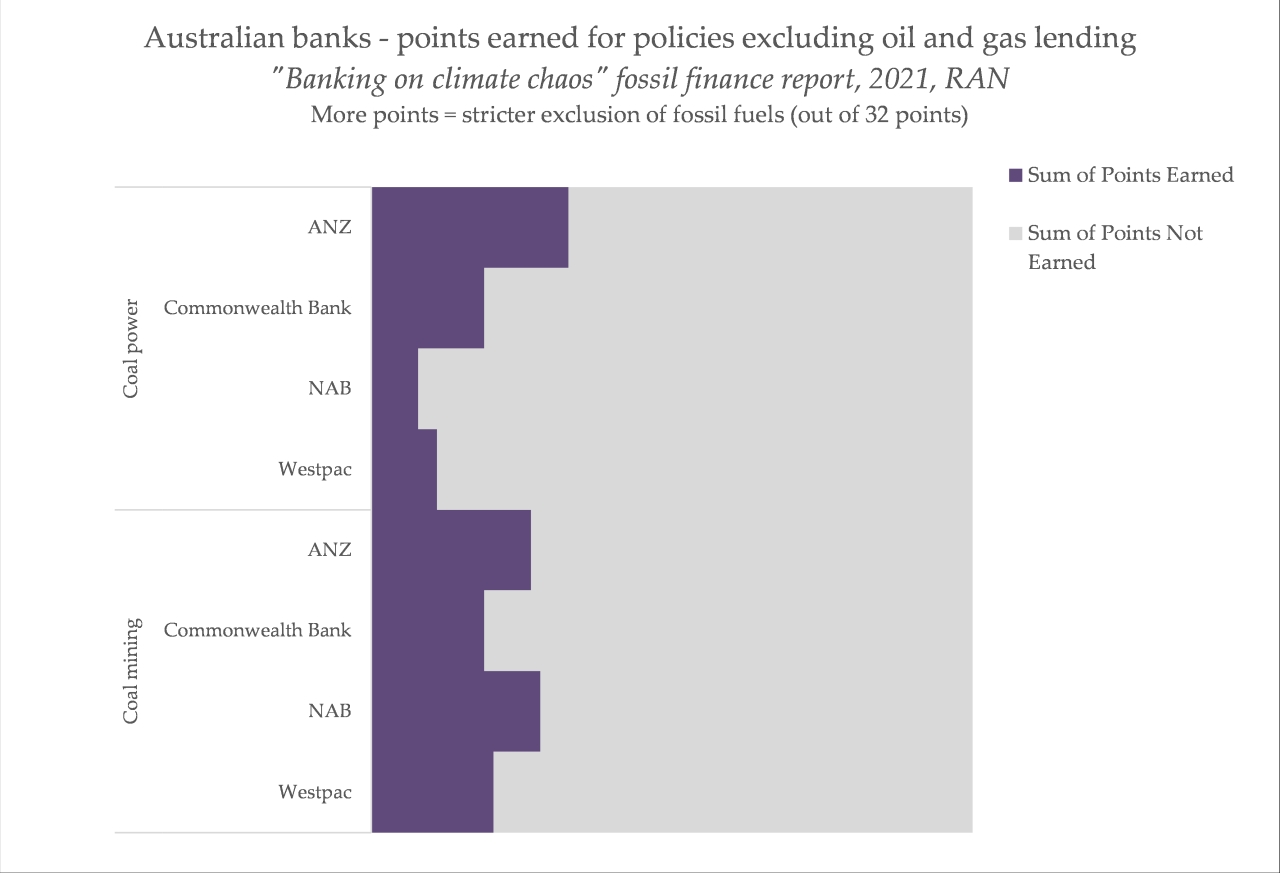

The lending policies of Australian banks are detail in the report, too, with points being assigned to each that positively attempts to exclude the financing of fossil projects. While some of Australia’s big four banks have policies limiting coal investment, there are few that limit other fossil fuels such as oil and gas:

ANZ stands out among the banks for the magnitude of its lending to fossil fuel companies. It ranks high in particular for lending to offshore oil and gas companies, ranking 25th in the world among all banks in terms of quantity of financing provided to fossil fuels extracted in this way.

“These numbers expose the hollowness of banks’ ever-multiplying commitments to be net-zero or align with the Paris Agreement climate targets,” said Lucie Pinson, founder and executive director of Reclaim Finance. “It’s clear that all banks need to replace empty promises with meaningful policies enacting zero tolerance for fossil fuel developers”.

Notably, each of Australia’s big four banks have joined the RE100 initiative, in addition to featuring claims of climate commitments on their site. But this new report shows that they are notable participants in a global problem of continued cash flowing to fossil fuel companies.